Have you received the dreaded “Alternative Income Source Identified” error while checking your SASSA SRD grant status? It can be confusing and frustrating, especially when you’re in genuine financial distress.

I’m here to guide you through understanding why this error occurs and how to fix it effectively. By following these steps, you can get your SRD grant application reconsidered and approved.

How to Fix the “Alternative Income Source Identified” Error? (Quick Answer)

To fix the SASSA SRD “Alternative Income Source Identified” error in 2025, submit a reconsideration request via https://srd.sassa.gov.za/appeals/appeal. Provide bank statements proving your income is under R624, explain exceptional deposits, and wait for SASSA’s reassessment.

What Does the “Alternative Income Source Identified” Error Mean?

This error means SASSA detected a potential source of income linked to your application, which may disqualify you from receiving the SRD grant. The SRD grant, valued at R370 monthly (Previously R350), is designed for individuals with no financial means or income above the set threshold.

SASSA uses an automated income verification system to cross-check your details with financial records. If deposits into your accounts exceed R624 in the prior month, the system flags your application under the “Alternative Income Source Identified” category.

Why Does This Error Occur?

The error can happen due to several triggers related to the income verification process. Here are the most common reasons:

If you share an account with a spouse or partner, their deposits may be counted as your income, even if the money doesn’t belong to you.

2. Freelance or Part-Time Work

Payments from gigs, part-time jobs, or self-employment can push your monthly income above the R624 threshold.

3. E-Wallet Transactions

Multiple small transfers into a digital wallet (e.g., mobile money) from friends or family can accumulate and breach the income limit.

4. Other Social Grants

Receiving grants such as NSFAS, disability, or old-age pensions might conflict with your SRD eligibility.

5. Incorrect Records

Errors in financial records or outdated banking details could mistakenly classify you as having additional income.

How to Fix the “Alternative Income Source Identified” Error?

If you genuinely qualify for the SRD grant, follow these steps to resolve the issue and submit a reconsideration request:

Step 1: Gather SASSA Appeal Supporting Documents

- Obtain bank statements showing all transactions for the last month.

- Highlight any deposits that don’t count as income, such as loan repayments or one-off transfers.

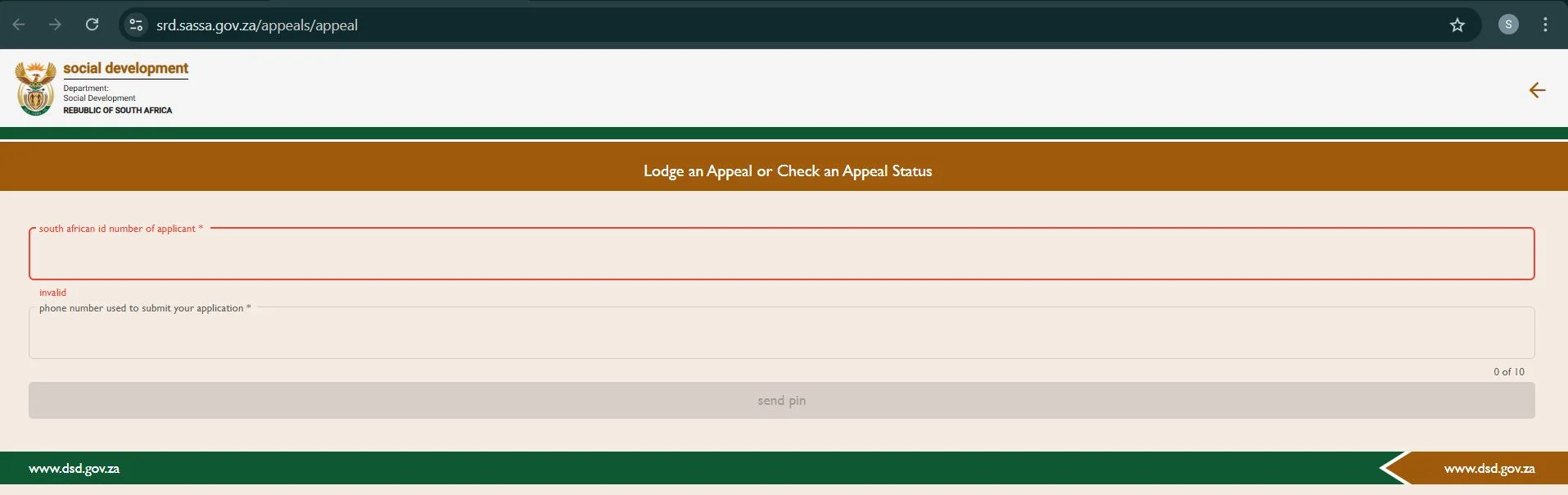

Step 2: Access the SASSA Appeals Platform

- Go to the official SASSA appeals portal:

https://srd.sassa.gov.za/appeals/appeal

Step 3: Submit a Reconsideration Request

- Enter your ID number and registered mobile phone number.

- Explain why your application was wrongly declined, providing specific details about your financial situation.

Step 4: Upload Supporting Documents

- Upload clear copies of your bank statements or proof that your total income is below R624.

- Provide a detailed explanation for any unusual deposits, such as family support or refunds.

Step 5: Check Your Application Status

- Monitor your Appeal status regularly through the SASSA portal from where you appealed

- Respond promptly to any additional requests for information from SASSA’s Appeals Committee.

How to Prevent Future Errors?

Taking the following precautions can reduce the risk of encountering the “Alternative Income Source Identified” error again:

1. Use Personal Bank Accounts Only

Ensure the bank account linked to your application is in your name and doesn’t include shared accounts.

2. Update Banking Details

Notify SASSA immediately if you change your bank account or switch to a digital wallet.

3. Monitor Monthly Income

Keep track of all deposits to ensure they don’t exceed the R624 limit. If you receive irregular support payments, inform SASSA beforehand.

4. Provide Accurate Information

During the application process, disclose all relevant financial details to prevent misclassification.

What to Do if Your Appeal is Rejected?

If your appeal is declined, you can still explore additional options to resolve the issue:

1. Visit a SASSA Office

Request a face-to-face review of your application with a SASSA officer. Bring all relevant documents to support your claim.

2. Seek Legal Aid

Many Organizations offer free legal assistance to help low-income individuals contest incorrect grant decisions.

3. Use Alternative Grant Channels

If your SRD application remains declined, explore other social relief programs offered by SASSA.

Frequently Asked Questions

Exclude any shared accounts when applying for the SRD grant. If you’ve already applied, submit a reconsideration request explaining the shared account details.

Q. Can I apply for the SRD Grant if I receive NSFAS funding?

No, individuals receiving other grants like NSFAS are usually ineligible for the SRD grant, as these are considered alternative income sources.

Q. How long Does the SASSA appeals process take?

The SASSA appeals process typically takes 60–90 days according to https://srd.sassa.gov.za/appeals/, but delays may occur during peak periods.

Q. What happens if I exceed the R624 limit by a small amount?

Even a small amount over the limit triggers the error. Provide evidence of why the excess amount shouldn’t count as income during the appeals process.

Q. How can I track my appeal status?

Visit the SASSA Appeals Platform to check the status of your reconsideration request.

My name is Zanele Dlamini, and I write to help people understand their SASSA status and benefits. I share clear and simple information about grants, payments, and requirements to make it easier for South Africans to get the support they need. My goal is to make the process simple for everyone.

Contents

- 1 How to Fix the “Alternative Income Source Identified” Error? (Quick Answer)

- 2 What Does the “Alternative Income Source Identified” Error Mean?

- 3 Why Does This Error Occur?

- 4 How to Fix the “Alternative Income Source Identified” Error?

- 5 How to Prevent Future Errors?

- 6 What to Do if Your Appeal is Rejected?

- 7 Frequently Asked Questions

![How to SASSA Change Phone Number for SRD Grant Online? [2025] How to SASSA Change Phone Number for SRD Grant Online? [2025]](https://sassasrdgovza.com/wp-content/uploads/2024/11/SASSA-Change-Phone-Number-for-SRD-Grant-1024x536.webp)